mississippi vehicle sales tax calculator

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. In addition to taxes car purchases in Mississippi may be subject to other fees like registration title and plate fees.

Mississippi State Sales Tax.

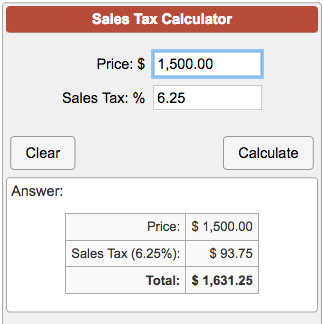

. Tax and Tags Calculator. Sales Tax calculator Mississippi. Once you have the tax rate multiply it with the vehicles purchase price.

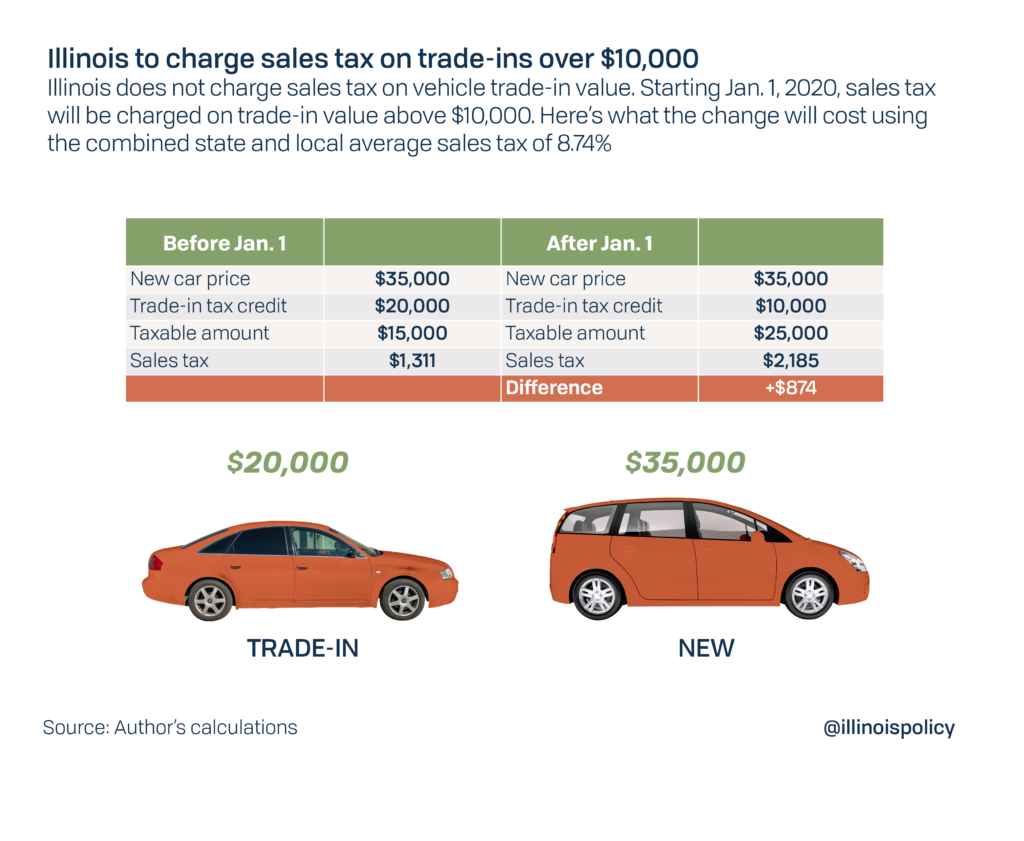

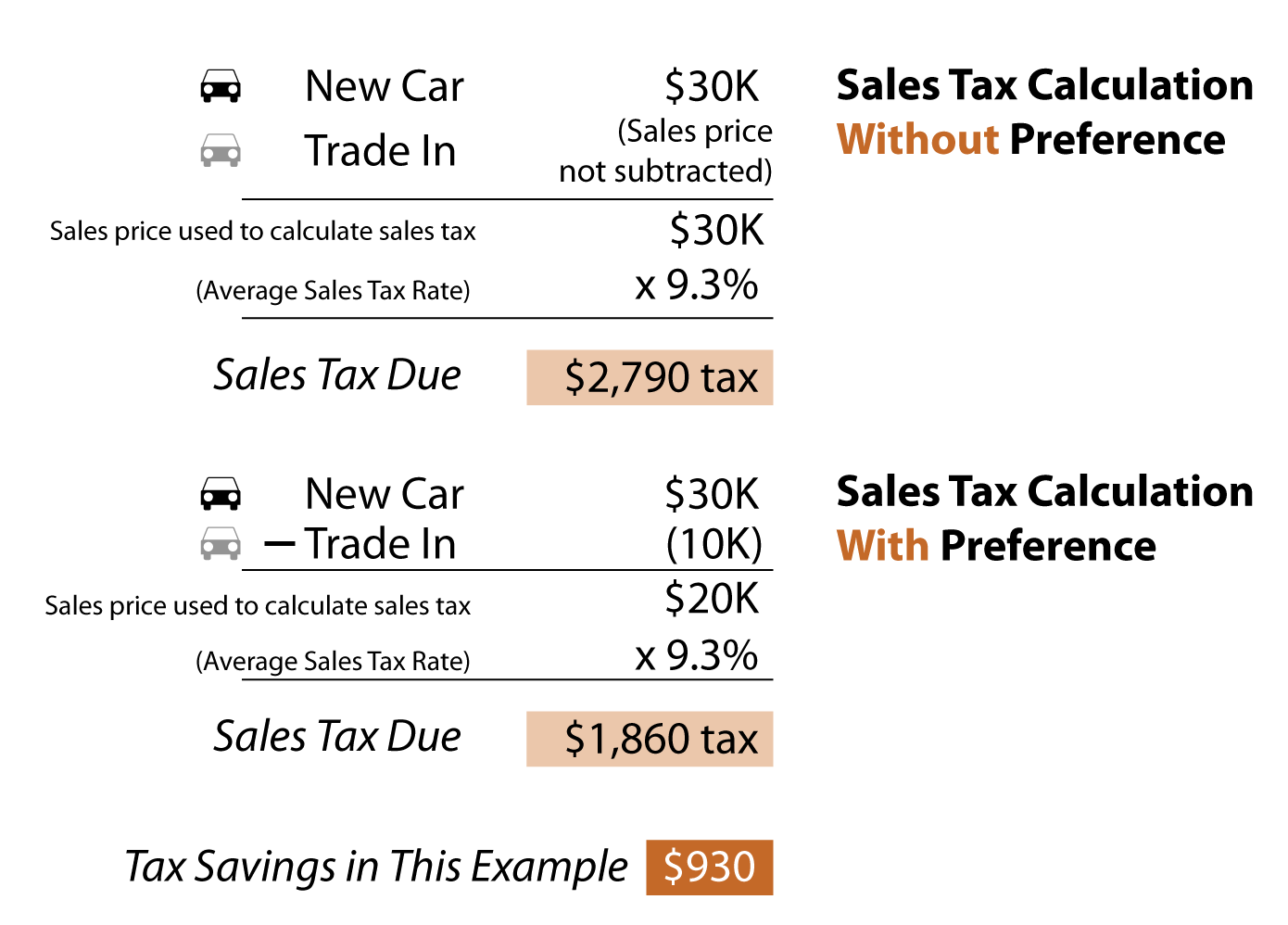

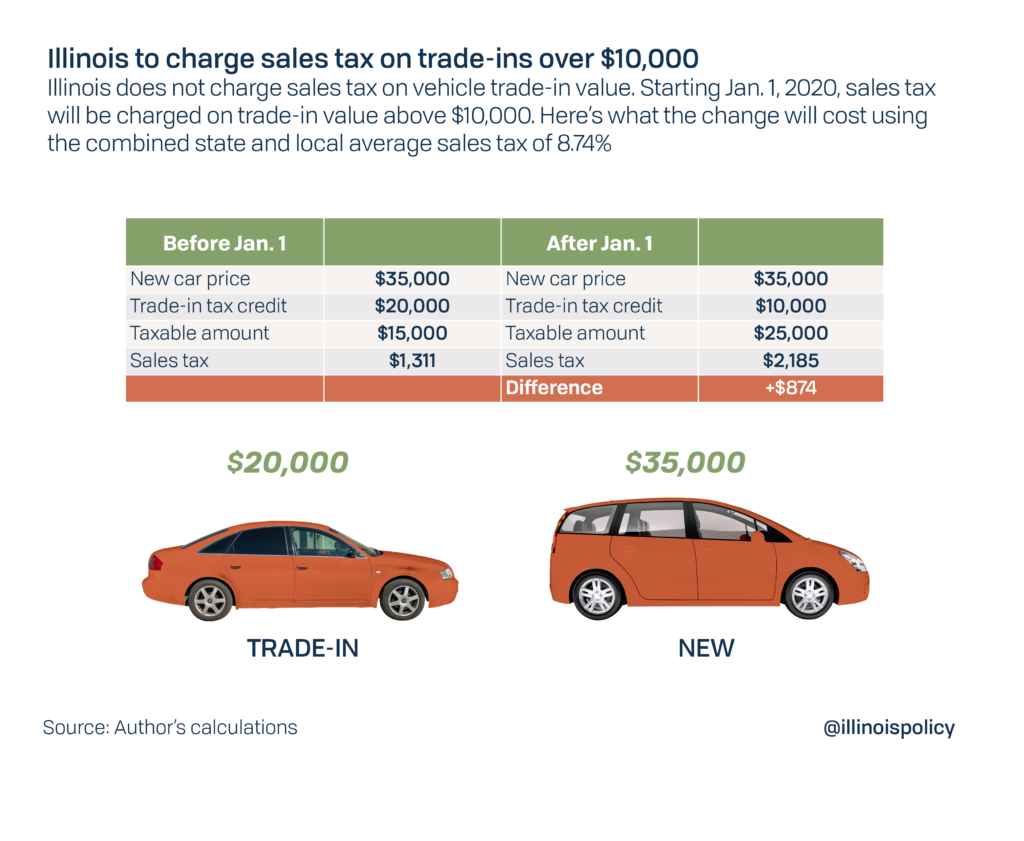

The county the vehicle is registered in. Motor Vehicle Licensing main page Motor Vehicle Assessments rule. You pay tax on the sale price of the unit less any trade-in or rebate.

Maximum Local Sales Tax. Registration fees are 1275 for renewals and 1400 for first time registrations. All the other taxes are based on the type of vehicle the value of that vehicle and where you live city county.

Before-tax price sale tax rate and final or after-tax price. Average Local State Sales Tax. For vehicles that are being rented or leased see see taxation of leases and rentals.

For additional information click on the links below. Home Motor Vehicle Sales Tax Calculator. You can do this on your own or use an online tax calculator.

In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle. Sections 27-65-17 27-65-20 27-65-25 The following are subject to sales tax equal to 7 of the gross proceeds of the retail sales of the business unless otherwise provided. 2000 x 5 100.

635 for vehicle 50k or less. You can find these fees further down on the page. Before engaging in any business in.

The type of license plates requested. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles. If you are unsure call any local car dealership and ask for the tax rate.

Sales Tax is based on gross proceeds of sales or gross income depending upon the type of business as follows. 1275 for renewals and 1400 for. Jersey Division of Taxation at 609-984-6206 help calculating your sales tax on the VALUES you SUPPLY easily.

Because of this tax rates are exclusively between 5 and 6 with an average of 5065. 775 for vehicle over 50000. Just enter the five-digit zip code of the.

Motor Vehicle Ad Valorem Tax Reduction Fund Legislative Tag Credit In order to provide a tax break to the registered owners of Mississippi motor vehicles the 1994 Mississippi Legislature authorized a credit to the owners in the amount of 5 of the assessed value of the motor vehicle. 1000 - If the Tax Collectors Office completes the Title Application 300 - Mail fee for tag and decal 5 - Use Tax if the vehicle is purchased from an out of state dealer. Car tax as listed.

Registration fees are 1275 for renewals and 1400 for first time registrations. Interactive Tax Map Unlimited Use. The tax is based on gross proceeds of sales or gross income depending on the type of business.

Motor vehicle titling and registration. New car sales tax OR used car sales tax. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Whether or not you have a trade-in. During the year to deduct sales tax instead of income tax if. The state in which you live.

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate of tax for an item. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Ad Lookup Sales Tax Rates For Free. Maximum Possible Sales Tax. Dealership employees are more in tune to tax rates than most government officials.

Sales and Gross Receipts Taxes in Mississippi amounts to 53 billion. A large number of counties in the Magnolia State do not levy any local taxthese county and local governments have the ability to include a 1 tax on car sales but many choose not to. Do I have to microchip my dog mississippi vehicle registration fee calculator Oahu mississippi vehicle registration a msb registration renewal fee be.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. It is 6499 of the total taxes 81 billion raised in Mississippi. All the other taxes are based on the type of vehicle the value of that vehicle and where you live city.

All vehicles sold in Mississippi are subject to the state tax rate of 5. Pay an annual fee of 75 Kokua Line. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

425 Motor Vehicle Document Fee. In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle. Subtract these values if any from the sale.

Tax Calculator For Items Clearance 54 Off Www Ingeniovirtual Com

Car Tax By State Usa Manual Car Sales Tax Calculator

Mississippi Sales Tax Guide And Calculator 2022 Taxjar

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Mississippi Income Tax Calculator Smartasset

Mississippi Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Dmv Fees By State Usa Manual Car Registration Calculator

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com